11 Apr Women-Founded Start-Ups are Less Likely to be VC-Funded than … Earth Being Hit by an Asteroid

The probability of planet Earth having a catastrophic collision with an asteroid is higher than the probability that a startup founded by all women will be funded by a US venture capital firm.

Startling, isn’t it? Read on.

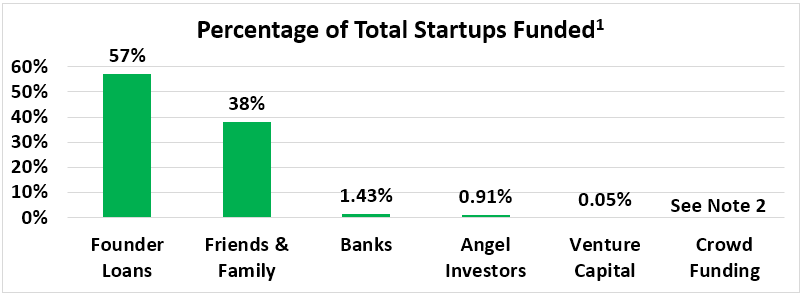

According to the entrepreneur.com article here, as seen in the chart below, venture capital firms fund about 0.05% (1/20 of 1%) of US startups.

1 Excludes ICOs.

2 According to the article here of StartEngine, one of the largest equity crowdfunding portals, as of February 2019, since inception only $176 Million has been raised via crowdfunding. In comparison, venture capital firms funded $130.9 billion across 8,949 US companies in 2018!

As recently widely reported, for example in the article here, of these 1/20 of 1% of startups funded by venture capital firms, only 2.5% have all women founders.

So according to the math:

0.0005 * 0.025 = 0.000125 of startups in America will have all women founders and will be funded by venture capital firms, or 1.25 of every 10,000startups.

In comparison, the odds of the earth having a catastrophic collision with an asteroid in the next 100 years may be as high as 1 in 5,000 according to the article here.

As revealed with a little more math,

- 1/5000 = .0002 odds of the earth having a catastrophic collision with an asteroid in the next 100 years

- 1.25/10,000 = .000125 odds of an all-women start-up being funded by a venture capital firm

- .0002/.000125 = 1.6

In sum, the earth is 1.6 times more likely to have a catastrophic collision with an asteroid in the next 100 years than a start-up with all women founders is to obtain funding from a venture capital firm!

As amusing as some may find the above comparison, it’s really quite a serious problem for America. Female human capital is simply not being given the opportunity to succeed, American entrepreneurship is stymied, tens of thousands of US jobs are lost, upward mobility is choked, and the US economy and future economic growth are being stunted – all of which, if left unchecked, will one day result in the US losing the current battle with China for worldwide technology dominance.

Moreover, venture capital funds are leaving “billions on the table,” according to Allyson Kapin, Founder of Women Who Tech, in a recent interview with Yahoo! Finance The First Trade, which is cited in the article “Women Who Tech founder: Investors ‘are leaving billions’ behind by not funding women-led startups.”

And, if you are a woman of color – the odds of securing venture funding approach zero. According to Ms. Kapin, only 0.0006% of venture funding has gone to women of color since 2007. Applying this metric to the $130.9 billion in 2018 venture funding noted in the chart above, only approximately $785,000 would have gone to firms founded by women of color. More information on the topic of funding to minority founders appears here, “Untapped Opportunity: Minority Founders Still Being Overlooked.

As noted in an earlier article of mine, US public policy is killing small business and entrepreneurship in America, keeping the poor “poor” and thwarting the American Dream of “Main Street” upward mobility: the US public capital markets, once the envy of the world, are in-hospitable to smaller-cap companies; US entrepreneurship is at historical lows[1]; on a GDP basis, the US surpassed only two of the world’s top 26 IPO markets — Mexico and Brazil — as to the number of smaller-cap company IPOs[2]; the Chinese are lapping the US in the number of total IPOs[3]; and millions of high-quality U.S. jobs have been forfeited.

To remedy this, a “big-tent,” bi-partisan, multi-racial, male/female coalition advocacy effort is being organized in Washington, DC. The coalition, named “JUMMP” (“Jobs, Upward Mobility, and Making Markets Perform”), is being spearheaded by David Weild, former Vice-Chairman of Nasdaq, New York-based investment banker, and “Father of “JOBS Act 1.0.” Pro-entrepreneur and pro-upward mobility Americans, including me and others, from both sides of the political aisle in Washington, DC, and throughout the US, are helping Mr. Weild.

The JUMMP Coalition’s objectives are to:

- restore America’s capital markets to their former health,

- create millions of US jobs,

- help US entrepreneurs regardless of color and gender succeed,

- reversing the increasing income inequality trend,

- reinvigorate the American Dream of upward mobility from one generation to the next,

- bring millions of Americans, especially minorities and others who have not realized the financial benefits of the US economic expansion, to the metaphorical “mountain top,” and

- assure the US maintains its worldwide technological dominance

In the meantime, until the JUMMP Coalition achieves these objectives, if you are a woman founder of a startup and your business plan requires venture capital funding – it would probably be best if you have a backup plan.

© Ronald A. Woessner

April 9, 2019

[1] Unpublished White Paper of David Weild, former Vice-Chairman of Nasdaq, New York-based investment banker, and “Father of “JOBS Act 1.0.” A “heat map” included in Mr. Weild’s White Paper shows that the number of start-ups in America in 2017 versus 2006 in the vast expanse of Middle America between the East and West coasts has decreased by approximately 50%.

[2] “Making Stock Markets Work to Support Economic Growth,” Weild, Kim & Newport for the OECD, July 11, 2013, at p. 54. For the period from 2008-2012 the U.S. had a disastrous “Efficiency Ratio” of GDP-weighted output of small IPOs — at only 0.4 IPOs per $100 billion of GDP (ahead of only Mexico and Brazil).

[3] According to Mr. Weild’s research, the number of public companies in China has increased by 381% since 1997, while the number of public companies in the US has decreased by 39%.

DISCLOSURE: The views and opinions expressed in this article are those of the authors, and do not represent the views of equities.com. Readers should not consider statements made by the author as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please go to: http://www.equities.com/disclaimer

No Comments